Inflation Is Here! – And Smart investors are putting their money into Agricultural projects to hedge against inflationary pressures.

Central banks and public financial institutions are increasingly finding themselves caught between a rock and a hard place.

First, the global COVID-19 pandemic forced banks to adopt unprecedented stimulus policies, pumping money into the economy at record levels. This move likely prevented a catastrophic double-crisis – one epidemiological, one financial – from occurring at the same time.

However, this move probably did not eliminate the threat of a financial crisis entirely. Instead, it looks like it may have simply delayed it for a year or two.

As vaccines become increasingly available and economies begin to open up, pent-up demand (enabled by easy monetary policy) is now accompanied by a global shipping crisis and labor shortages. These factors combine to create perfect storm conditions for rampant inflation.

What Exactly Is Inflation, and Why Does It Matter Now?

Inflation is the tendency of money to lose its purchasing power over time. As economies and populations grow year over year, every individual dollar in the financial system loses a little bit of its value.

This is why a jug of milk cost $0.40 in the 1920s and now costs ten times as much today. It’s also why banks, financial leaders, and retail investors are scrambling to find assets that can maintain their value even while the price of everything else rises around them.

Most economists agree that a little bit of inflation is a good thing – it signifies a healthy economy. The U.S. Federal Reserve aims to maintain a 2 percent rate of year-over-year inflation and manipulates the cost of borrowing money – the interest rate – in order to do that.

Under normal circumstances, central banks simply raise interest rates to keep inflation from rising to dangerous levels. The reason today’s central banks and public financial institutions are having such a hard time dealing with inflation is that they can’t raise interest rates – at least not while the country is still recovering from the pandemic, going through a container shipping crisis, and suffering a national labor shortage.

This has investors, retirees, and business owners from every corner of the country rightfully worried. The higher the inflation rate goes, the less your cash assets and savings are worth. If inflation does take off, people who haven’t invested their wealth in inflation-resistant assets will end up losing a great deal of money.

Agriculture As an Inflation Hedge

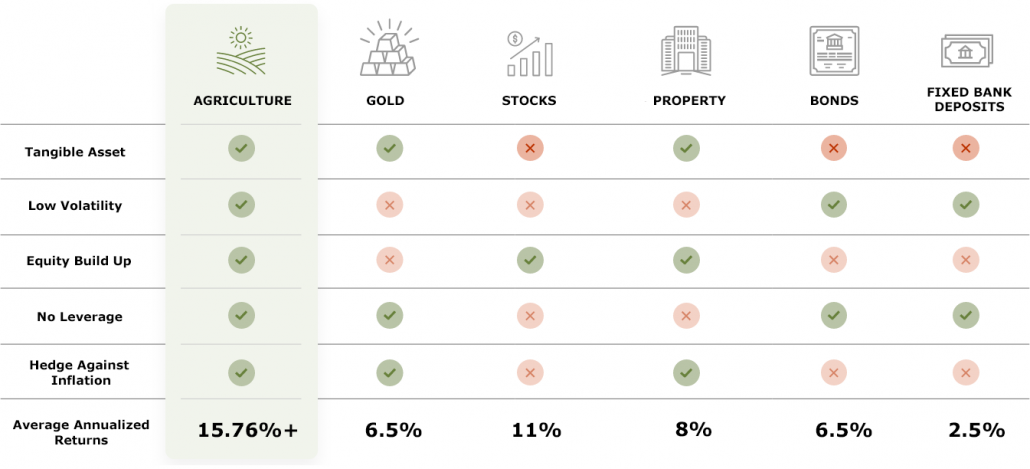

People are preparing for inflation in many different ways. Some are investing their money in equities that they think will generate high enough returns to beat inflation. Others are looking at gold, commodities, and even cryptocurrencies to store value during this period of uncertainty.

However, the most prudent investors are looking at real estate as their hedge against inflation. Historically, real estate has risen in value faster than inflation, and Agriculture in particular tends to appreciate in value significantly when the general economy is suffering.

Between 1971 and 2008, whenever the economy started overheating, Agriculture values rose more than inflation. According to NCREIF index data:

- During periods of 3 percent inflation, Agriculture prices rose by 8.3 percent

- When inflation rose to 4 percent, Agriculture prices rose by 12 percent

- When inflation reached 6 percent, Agriculture prices rose by 15.7 percent

Investing in Agriculture carries attractive benefits that the office and residential real estate sectors do not generally offer. Office REITs were among the hardest hit by the COVID-19 pandemic, and remote work continues to create uncertainty in the market. Residential real estate is a historically popular option, but for many investors, the memory of the 2008 housing crash is still fresh, and prices around the country have already been pushed to record levels.

Ultimately, all non-Agriculture real estate investments depend almost entirely on location. If urban metropolitan centers continue making money, their real estate industries will prosper – but what if they don’t?

Agriculture is unique among real estate assets because it is highly resilient to location pressure. Agriculture is typically remote by design. It doesn’t depend on tourism, development, or even economic growth to sustain its value. At most, it requires good, predictable weather and a local workforce to generate value.

This makes a strong case for Agriculture as an income investment that can act as a powerful hedge against inflation. It not only retains its value in ways that other asset classes do not, but it also generates income through the cultivation and sale of crops.

Agriculture As an Income Investment

It’s hard to generalize Agriculture income because there are so many different types that can be earned. Permanent crops like citrus and nuts may take several years to begin production, but they also offer high yields and excellent land appreciation opportunities. Row crops like grains must be replanted every year and usually require heavy machinery to harvest.

Then after harvest, every crop has unique processing, packing, and logistics requirements. Agriculture logistics is a complex and dynamic field that demands qualified expertise. The more experienced your farm management team is, the greater your returns will likely be.

But these are issues that farm operators spend their entire careers addressing. Individuals interested in adding Agriculture to their portfolio only need to identify which opportunities have shown over time to successfully and consistently produce income and profits for their owners.

Agriculture Investment with Inflation-Beating Returns

Every investor wants to avoid the oncoming inflationary crisis, but very few know how to do it. Plantations International offers a unique opportunity with our vertically integrated model that takes all of the work out of a historically labor intensive investment. Our mission is to make Agriculture ownership easy for everyone, and that means we handle all of the work on the ground – finding and securing premium Agricultural projects, establishing selling agreements with global retailers, and hiring a management team that can consistently produce a profit – while our clients earn a steady, inflation-resistant return. Visit our opportunities page to see what projects are currently available and how they can help you generate inflation-beating returns.